- Greece: 22:36

- |

- Sydney: 05:36

- |

- Melbourne: 05:36

- |

- GMT: 19:36

- |

- London: 20:36

- |

- New York: 15:36

- |

- Los Angeles: 12:36

Greek Lawyer

News

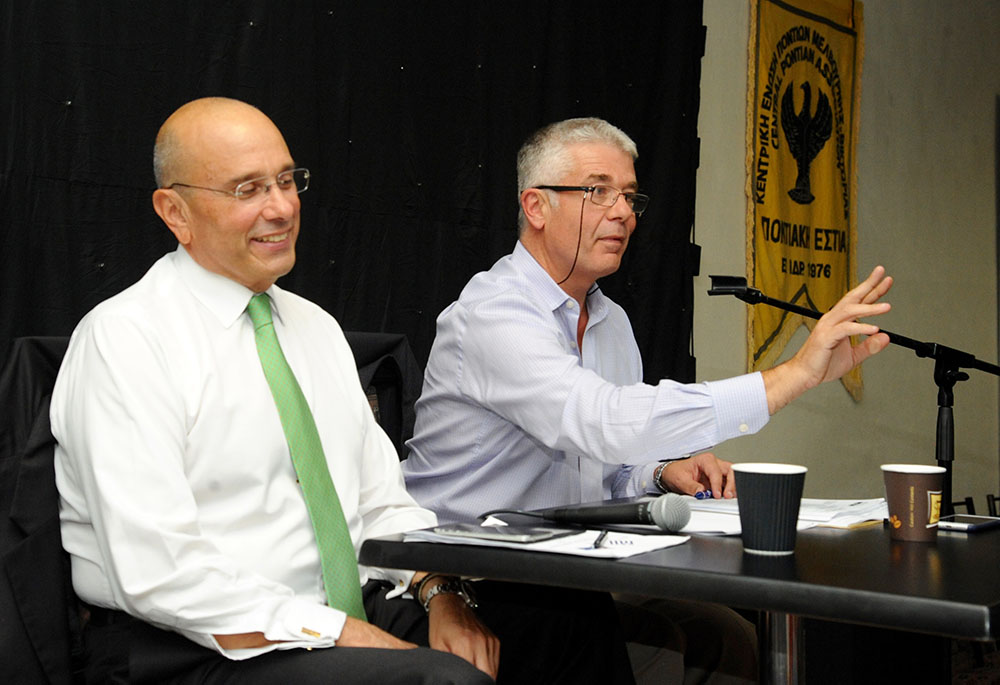

“Mr Tripidakis, lectured on pensions and real estate property in Greece and Australia together with the financial planner Mr H. Petropoulos.The event was hosted by the Melbourne Pontian Association (Estia)”. (February 21, 2017)

Mr Tripidakis lectured the Hellenic Australian Lawyers in Adelaide on Greek law, with the presence of the SA Chief Justice. (Feb 12, 2016)

Mr Tripidakis has been interviewed about the Greek Tax reforms by the Melbourne Greek Radio

Mr Tripidakis attended on March 4, 2015 the dawn service in Martin Place, Sydney, to commemorate the centennial anniversary of the ANZACS campaign to Galipoli during the WW1, using as base the island of Lemnos.

Mr Tripidakis participated for the 6th year at the Lonsdale street Festival in Melbourne (Feb 14-15 , 2015)

Working together with the Greek D. Minister of Foreign Affairs, Mr A.Gerontopoulos and the Head of IKA, Mr R.Spyropoulos, towards the prompt and smooth payment of IKA pensions to GreekAustralians. Athens, December 2014

Μr Tripidakis delivered, a lecture at the Singapore Hellenic Business Network, about the recent tax reforms in Greece, on December 15, 2014

New real estate tax ENFIA applies to all property owners in Greece, regardless of where they reside

neoscosmos.com, September 9, 2014

Press here

Save your property in Greece

neoscosmos.com, July 1, 2014

Press here.

Μr Tripidakis attended the 2013 Battle of Crete commemorative celebrations in Melbourne

Greek Australians face tax increases on overseas properties

Property Observer, April 4, 2013

Press here.

ERT World Australia: Episode 20

March 7, 2013

Mr John Tripidakis invited with the Consul General of Melbourne by the Greek Community of Melbourne, to analyze the new Greek Tax laws—Feb 2013.

Greek Australians frustrated over new Greek Tax Laws

Neos Kosmos, February 2013

Pursuant to tax law No 3943/2011, as implemented by the Ministerial Decision No 1217 of December 2012, serious changes have been effected on the tax imposition for foreign residents. According to the provisions of this law, it is not enough for an individual (taxed solely for his income in Greece) to just “declare” that he is a permanent resident of Australia, but moreover this has to be proved through a series of documents .

These documents are :

- The (Australian) tax return, or

- The (Australian) notice of tax assessment, including the global income.

- If none of the above can be produced, then a certification from any (Australian) Public Authority (e.g. The Town Hall) evidencing the individual’s permanent residence is required.

Additionally the above documents need to bear the note “apostile” by the Department of Foreign Affairs and Trade (Level 13/ 2 Lonsdale street)

Then, they must be officially translated into Greek (here or in Greece).

Finally your representative/accountant in Greece must submit them to your competent Tax Authority.

In case that the above documents are not submitted or are submitted after the passing of the deadline, the tax payer will be considered as a Greek resident and will be taxed in Greece for his world wide income, including his Australian income and the estimate or presumed income/”tekmirio” (in case such provisions apply). Moreover, the tax burdens that apply for Greek residents, such as the presumed income, collection of receipts, etc will apply for him as well. The only exemption applies for agricultural income up to 500 €/ per year, as well as for interest received on deposits from bank accounts. For the fiscal year 2012, the deadline for submitting the required documentation to the Greek tax authority expires on March 29, 2013.

All the above are general provisions of the law. Each case has its own merits. Our advice: Since Greek tax law has become very complicated, new provisions come to force and the consequences are serious, we strongly suggest that you seek promptly professional advice from your Greek tax accountant, who is familiar with your tax profile and may advise you accordingly.

The new Greek tax law — Impact on Greek Australians

Ta Nea, January 21, 2013

On January 11, 2013, the Greek Parliament in its pursuit to increase tax scrutiny and revenues has voted the new tax law. This tax reform changes significantly the taxation of Greek citizens, as well as the taxation of foreign residents, who are subject to income taxation in Greece. The main changes, concerning Greeks residing abroad, include the following:

- Foreign residents/ Greeks residing abroad, having, not only actual but even presumed income in Greece (“tekmiria”, such as maintaining a residence, buying property etc) should be filing a tax statement. Their appointed tax representative is jointly and severally responsible with them for the submission of their tax statement.

- Foreign residents/ Greeks residing abroad, that are liable to payment of income tax in Greece (through e.g. collection of rents, pensions, etc…), are not entitled to the reductions provided for Greek residents, such as the collection of tax receipts, receipts for medical expenses, gifts to churches, to non profitable institutions, etc.

- Rents collected are taxed on a separate tax scale. For rents up to 12.000€, the tax payer is taxed by 10%, while for amounts exceeding 12.000 €, the tax rate is 33%. Additional tax of 1,5% or 3% (for business leases and for properties over 300 sq.m.) is imposed on the gross rental income.

- Property conveyancing (sale, parental gift, inheritance, etc.) either in full or in undivided interest shares, effected after January 1, 2013 is subject to a 20% capital gains tax. The tax is imposed on the difference between the value that the property had at the time of acquisition and of the value of the property at the time of the disposal.

- With regard to the property tax (“haratsi”) that is collected through the power supply (“DEI”) bills, the owner of the property can request the disconnection of the tax from the electricity bills and its direct payment to the tax authority (avoiding the tenant’s deduction from the monthly rent, in case that the property is rented).

- Last but not least, a new imminent obligation: Owners of plots outside the city limits or the urban plan (“ektos shediou”), must declare the details of their properties, electronically, through the Greek Ministry of Economics’ web page. The deadline for such amendments expires on June 30, 2013.

On a different but very serious issue, we remind that the obligation for submitting documents proving the residency and taxation outside Greece, has been extended through to March 29,2013

Are Greek Australians having income in Greece, considered as residents of Greece for tax purposes?

The Kytherian, November 20, 2012

Pursuant to the latest tax law 3943/2011, several changes have been effected on the tax imposition for foreign residents,. According to the provisions of this law, an individual is considered as a Greek resident – and taxed for his global income – , in case that he resides in Greece for a period of more than 183 days within the same year. For the current fiscal year and from now on, the tax payer must prove that he is a foreign resident, by providing the tax authority with the required certificate of tax residence (Pistopiitiko Forologikis Katikias) or the required documentation.

How is the residence proved? For the countries that Greece has entered into bilateral treaties for the avoidance of double taxation, the execution of a specific form (“certificate of tax residence”) is provided, which is stamped and verified by the competent foreign tax authority and then submitted to the Greek Tax Authority. For other countries with which such treaties do not apply (such as Australia), the Tax Authority accepts the following evidence/ documentation as a proof of the permanent residence abroad:

- tax statements of the individual submitted to the foreign country,

- evidence showing the individual’s employment,

- permanent insurance and residence abroad documentation,

- copies of the tax payer’s passport and/ or air tickets, depicting the time period that the individuals stayed in Greece.

In case that the documents/ evidence depicting that the individual did not reside in Greece for a period of more than 183 days per year are not submitted or are submitted after the passing of the deadline, the tax payer will be considered as a Greek resident and will be taxed in Greece for his world wide income, including his Australian income and the estimate of presumed income/”tekmirio” (in case such provisions apply). Moreover, the tax burdens that apply for Greek residents, such as the presumed income, collection of receipts, etc will apply for him as well. The only exemption applies for agricultural income up to 500 €/ per year, as well as for interest received on deposits from bank accounts. For the current fiscal year (2012), the deadline for submitting the required documentation to the Greek tax authority expires on December 31, 2012.

Acts on your properties in Kythera that should alert you!

The Kytherian, October 21, 2012

Possession of a property is not only a physical action on a property but also a legal right protected under Greek Real Estate Law. Greek law regulates the possession as “the actual power on a property, exercised by a person who acts as its owner”. It is not necessary for the owner of the property to be physically present at the property to exercise his possession rights, but such right can be exercised through his appointed representative, power of attorney, his tenant or by allowing a third person to cultivate the property, occupy it, store things on/in it etc.

Possession of a property can be contested or disturbed. Such contest or disturbance can be effected by a third person possessing the property, claiming that he is legal possessor or excluding you or your representative in Greece from the usage of your property.

Common acts of contest are the following:

- when a person fences your property to his benefit;

- when someone fences together with his adjacent property a part of yours as well;

- when someone places signs anywhere on your property, naming the property as his;

- if someone seizes your property;

- when someone places locks without allowing you to enter the property;

- when the lease agreement has been terminated/expired and the tenant refuses to evacuate the property nor does he pay any rent;

- when the third person proceeds with the cultivation of the property without having an agreement with you;

- if a person collects the crops or does not allow you (or your representative) to collect the crops of your property;

- if a person does not allow you to use the well of your property;

- if the local shepherd passes his sheep through your property;

- if your neighbor parks his car on your lot etc.

The above actions are usual hints, which indicate that someone may contest or disturb your possession rights and is likely to claim adverse possession rights on your property. As we have repeatedly said, this squatter may take lawful ownership on your property after the lapse of 10 or 20 years, without you being able to defend it.

How can the above be countered? A Court lawsuit should be filed at the competent court, requesting the prohibition of the squatter to perform such acts, or even injunction measures before the local Magistrate’s Court for the temporary prohibition. However, there is a short deadline of one year as of the first squatter’s actions in order to pursue the injunction measures.

Our suggestion in order to avoid the costly and lengthy litigation in Greece against the adverse possession is:

- fence it and “keep an eye” on your property; ask a friend or relative to take a photo every year and e mail it to you.

- take care of your legal obligations (Acceptance of Inheritance, E9 etc) and

- if you have a tenant, worker, keeper, farmer, “friend” that is using your property, make sure that you have an agreement in writing.

Registration of Titles at the Greek Land Registry (“Metagrafi sto Ypothikofilakeion”)

The Kytherian, August 18, 2012

“I have the Title (simvoleo) on my Greek Property to my name. Do I have the ownership?” Well, the answer is that if this Title is not registered with the Land Registry (Ypothikofilakeion), you do not have ownership. “And how is this registration proved?” Only through a Certificate of Registration (Pistopiitiko Metagrafis) from the competent Land Registry.

Greek Civil Code provides that ownership rights on real estate properties in Greece is effected only through the registration of the Deed to the competent Land Registry (“Ypothikofylakion”) and/ or Land Registry Bureau (“Ktimatologio”) archives. Therefore, the lack of registration of the title to the Land Registry archives means that the conveyance has not been accomplished and that the new “owner” has not acquired ownership rights on the real estate property. Only upon registration of the title to the Land Registry archives (and no sooner than the registration), the new owner acquires his ownership rights and becomes the legal owner of the property from that point of time (and from the time of execution/ issuance of the title). The only exemption is provided for Inheritances, since upon registration of the Acceptance of Inheritance Deed to the Land Registry archives, it is considered that the heir has acquired ownership rights on real estate properties as of the time of the deceased’s passing.

Which titles are recorded to the Land Registry? Greek Civil Code names specifically the titles which are recorded to the relevant archives: a) any title “inter vivos”, such as sales, purchases, exchanges, notarial partitions, gifts, parental gifts, etc., concerning real estate properties b) any administrative act granting ownership, c) any report of court partition/distribution of real estate properties, d) any final court judgment related to real estate properties in Greece and e) acceptance of inheritance deeds concerning real estate properties.

The Land Registrar records to the Land Registry archives, the summary of the title to be recorded (naming the participating parties, the type of conveyance, the specifics of the property-ies and the ownership rights under conveyance). In addition to the above and apart from the summary of the Deed, the interesting party has to provide the Land Registrar with an application requesting the registration of the Deed, a certified copy of the Deed, as well as the relevant conveyance tax statement.

Is there any deadline for recording the title to the Land Registry archives? Greek Law does not provide such deadline. The Title can be recorded at any time after its execution. However, considering that lack of registration means lack of acquiring real estate ownership rights and the principal of time priority (meaning that the person who records first his title acquires the conveyed ownership right), leaving nothing else than a claim to the person who has not recorded his title, it will be important to proceed with recording the title to the competent Land Registry archives immediately after its issuance and/ or execution. Moreover, in case that the title is recorded after a year from its execution, the Land Registrar requires from the competent tax authority, the re-evaluation of the property’s tax value.

The competent Land Registry for the recording of the Deeds is the Land Registry of the area where the property is located. If the conveyed properties are located in the prefectures of different Land Registries, the Deed has to be recorded to all competent Land Registries.

So, if you do not have a Certificate of Registration together with your Title, make sure that:

- you confirm its legal status through a title search in the Land Registry, and

- you procure the relevant certificate.

Probate of Greek Wills

The Kytherian, July 23, 2012

Greek Inheritance Law provides the bequest of the deceased’s property to his legal heirs in two ways: through a Will, or in intestacy. In case that the deceased has left a Greek Will, the bequest of the inherited property, i.e. the transfer of the property under the names of his heirs, appointed by the deceased, and to what property assets they are entitled to, is regulated according to the provisions of the Will. Greek law provides three types of Wills: The holographic will; the public will and the secret will.

Upon the death of the testator, anyone who holds a Will must forward it to the competent Court or Authority, in order to be probated and the content of the Will to be known to everyone. Therefore, the person who holds the handwritten Will or the Notary who holds the public, the secret or the handwritten Will which has been delivered to him, has to apply to the Probate Court in Greece for its probate. The competent Court for the probate of the Will is the Magistrate Judge (“Protodikeion”) of the area where the Notary Public has its seat or the Magistrate Judge of the place where the person who holds the Handwritten Will forwards it for its probate. Only the original document can be submitted before the competent Probate Court, regardless of its validity. Copy of a missing will, cannot be probated, even if it is a certified copy of the will or a photocopy of same.

The probate is effected by providing the Magistrate Judge with the original Will at an open hearing of the Court. The Judge verifies that the document provided is a Will and that there are no typical flaws which affect its validity and attaches the content of the Will to its Minutes. The Probate Judge does not have the right to rule on any flaws regarding the content and the provisions of the Will. Upon probate, the probated Will is recorded to the Court’s Will recorder, and all Wills probated all over Greece are forwarded to the Court where the deceased had his last residence and to the Athens Court Central Will Recorder. Hence, any Will probated and recorded to any Greek Court may be located through the Athens Court Will Recorder.

Greek law also regulates the issue of the deceased having a Will, which has been already probated by a foreign Court; for example an Australian Will which encompasses the Greek property directly or indirectly. Such Wills are valid in Greece. An exemplified copy of this probated (by the Australian Court) Will , should be registered at the Greek probate court. If the Will or any part of the Probate Ruling is in a language other than Greek, it has to be first officially translated to Greek by a Greek attorney or the Translating Department of the Greek Ministry of Foreign Affairs. The Court certified copy of the Will , its translation to Greek, along with a copy of the deceased’s death certificate are recorded by the competent Court to their Will archives.

Finally, it should be stressed that inheritance rights are accomplished after an “Acceptance of Inheritance” is accomplished. It is only then that the Greek property is conveyed under the heir’s names, and not just by the existence/probate of a Will.

If you travel to Kythera this summer …

The Kytherian, June 16, 2012

The trip to Kythera has inspired and still does, many throughout the centuries. This destination has been the “oistros” for poets, painters, directors etc. The island has been the birthplace of the ancient goddess of beauty, Aphrodite, the hideout of Paris and Helen upon their escape from Sparta and the inspiration of the famous painting of Vato, while the Trip to Kythera is considered as a synonym of the unexpected, the unique and the ideal. It is also the dream of those originating from Kythera, who are always looking for a way to return back and visit the island.

If you travel there this summer and while enjoying the beauties of the island and rejoining with family and friends, you should also look into your legal matters there towards securing your legal interests and avoiding the unexpected.

The first thing you would need to confirm and verify would be the legal status of your properties. The provisions of Greek Law regarding the transfer of ownership, constitute the title search as an indispensable step towards determining and claiming ownership rights on a property.

Hence, in case you:

- are not in possession of the Deeds of the properties that you are entitled to; or

- you are not in possession of the Deed’s certificates of registration from the Ypothikofylakeion; or

- in case that you believe that someone has taken advantage of the fact that you are a foreign resident and has raised a claim against you and your assets; or

- you are not sure what is happening, to which properties and to what percentage you are entitled to,

the only solution would be to proceed with a title search before the Land Registry, verify that your ownership titles have been duly recorded to the Land Registry and that your property is free from any claim, lien, mortgage, seizure, lawsuit, or any encumbrances; or in case that nothing has been recorded or the entries are erroneous, proceed with the necessary legal actions towards amending the Deeds and any deficiencies. Note that title searches can be effected exclusively by lawyers.

In furtherance to the above, the island of Kythera has been proclaimed under registration to the Hellenic National Cadastre (Ethniko Ktimatologio) since January 2010. Although the relevant deadline for submission of the required documentation has not been set yet, when this happens, owners of properties in Kythera, will be called to submit their relevant documentation (Deeds, drawings, certificates of registration, certificates of Greek Tax File Number) along with the relevant application. Hence, we recommend to:

- perfect your Title; and

- obtain copies of all required documents; and

- proceed with a topographic diagram of your property, according to the national co-ordinates system and including building regulations,

in order to be ready for their submission when the relevant deadline is set

Another important issue you would need to take care of would be your tax liabilities. Pursuant to income tax law, each person who has acquired property in Greece is liable to submit E-9 tax statement. The submission of E-9 tax statements was compulsory for every person holding ownership rights for the fiscal years 2005 and 2008, while for the current fiscal year (and for all other fiscal years except 2005 and 2008), liable to submission of E-9 tax statements is among others, every person who acquired ownership rights (full ownership, naked ownership, life estate or right of residing on a property) either in full or in undivided interest on real estate properties in Greece within the previous year and every person whose property status has changed within the previous fiscal year.

Finally, beware of the adverse possession (“hrisiktisia”). Foreign residents usually assign the management of their properties to a local power of attorney, in order to cultivate, clean, exploit, reside to the properties and defend them from trespassers. In order to avoid any future surprises and any claims, it would be advisable, while being in Kythera, to execute an agreement of lease or of a free usage of the property, confirming in writing the terms of your agreement with your caretaker and/ or tenant, just to verify that no one will take advantage of your physical absence. Remember, scripta mannent verba volent! (words fly, it is the written that remain!)

Finally, one last issue is old Powers of Attorney to people that they are no longer representing you. As their revocation is not effected automatically neither orally, law requires the execution of a Revocation Act before a Notary Public and its service to the grantee. If this representation is not further required, revoke it.

So, why not take advantage of your trip to Kythera and dedicate some time to secure your interests there and protect the land that your ancestors have granted you with?

See you in Kythera in July!

Do all Greek Australians need to file E-9 Tax Statements in Greece?

OPA Magazine, May 19, 2012

The E-9 is a tax statement form through which the tax payer declares his/ her ownership rights on real estate properties in Greece. Such property tax statements have been submitted in the past together with the income tax statements (E-1, E-2, etc..) before the competent Tax Authority, while for the current fiscal year, the relevant Ruling of the Greek Ministry of Economics provides that the E-9 tax statement can be filed only electronically (unless specific exclusions apply), through the Ministry’ official web submission system (“taxisnet”) by the end of July 2012.

The submission of E-9 tax statements has been compulsory for every person holding ownership rights for the fiscal years 2005 and 2008, while for the current fiscal year (and for all other fiscal years except 2005 and 2008), the following persons should file E-9 forms:

- Every person or legal entity who acquired (through inheritance, purchase, parental gift etc) ownership rights [(full ownership (“kiriotis”), naked ownership (“psili kiriotis”), life estate (“epikarpia”) or right of residing on a property (“oikisi”)] either in full or in an undivided interest on real estate properties in Greece within the previous year.

- Every person or legal entity whose property status has changed within the year 2011 (e.g. sold some property).

- Every person whose family status, as declared to the previous E-9 tax statements, has changed (e.g. married).

- Every protected member of the family (i.e. children), who is liable to the submission of income tax statements and whose property status has changed within the year 2011.

Hence, any person or legal entity whose property status has changed within the year 2011, is liable to declare such change to the E-9 tax statement of the current fiscal year. Liable to the submission of such tax forms is not only the person who acquires the property, but also the person who conveys, gifts, bequests his ownership rights on real estate properties in Greece. For the deceased, the E-9 tax forms are filed by his/ her heirs.

The E-9 tax statement can be filed either by the tax payer in person or in case of a foreign resident through his appointed representatives. Should the relevant form be filed electronically, the relevant serial code must first be obtained by the competent Tax Authority.

All the above procedures can be accomplished through a Limited Power of Attorney to a specialized lawyer

Do Greek Australians need to file Income Tax Statements in Greece?

OPA Magazine, May 1, 2012

Any natural person, receiving income in Greece is obliged to submit income tax statements there, regardless of his nationality or his residence, as long as his or his spouse’s annual income exceeds the amount of 3.000 € or, even where his income is less than the amount of 3.000 €, if this income includes losses from agricultural or commercial activity. However, subject to the submission of income tax statements in Greece is any natural person who is subject to income tax only for the income that derives in Greece (regardless of the total amount of income).

Foreign residents are taxed for the income that is received in Greece. In general, foreign residents are taxed under the same provisions as Greek residents, with several particularities applying for them. Therefore, obliged to file income tax statements in Greece, are people who may reside abroad, but receive income in Greece, actual or presumed (i.e. from purchase of properties, from building constructions, purchase of cars of high value in Greece, purchase of boats, etc..), when their annual income is over €3,000 for the specific financial year.

Regardless of receiving actual income in Greece, foreigners/Greeks residing abroad are obliged to file income statements in case that they:

- received income from leasing real estate property in Greece and their income is over €600per year;

- acquired real estate properties in Greece or raised buildings;

- run their own business in Greece;

- purchased cars, boats etc in Greece;

- are members of a partnership (personal company); of a limited liability company; a joint venture; or a company of the Greek Civil Code which practices in Greece;

- are called to file income tax statements, upon the invitation of the Director of the competent Tax Authority;

- own in Greece one or more secondary residences;

- have acquired rights of full or naked ownership/remainder (“psili kiriotis”) or right of life estate (“epikarpia”) or right of residence (“oikisi”) on real estate properties within Greece.

The deadline for the submission of income tax statements for the current year (2012) expires on June 15, 2012.

The Holographic Greek Will

OPA Magazine, May 1, 2012

According to Greek Inheritance law, the bequest of the deceased’s property to his/her legal heirs is effected in two ways: by virtue of a Will or in intestacy.

Greek Law provides three types of Wills: The Public Will, the Secret Will and the Holographic Will. The Holographic is the easiest and cheapest Will, written entirely by the hand of the testator, who must include the word “Will”, its date and signs same, verifying its content. The Testator is not required to follow any type of formality towards drafting a holographic Will, other than to state to the document his wish for the bequest of his Estate upon his passing. In fact, according to Greek Law, the holographic Will can be in a form of a private document or of a letter, showing the last will of the Testator.

Since the Holographic Will has to be written entirely by the hand of the testator, it is implied that it is void, if it is written through mechanical means, i.e. through a computer, a typewriter, a tape.

Is the handwritten Will required to be drafted in Greek? No, Holographic Wills can be written in any language, provided that the Testator was aware of that language and was able to express himself.

Any addition in the side of the will or any postscripts have to be signed by the Testator, otherwise, they are not taken into account. Any erasures or any deletions are noted by the Probate Court and given their importance can result to the partial or total nullification of the Will. In general, Greek law forbids the interference of third parties to the drafting of the holographic Will, in case that it is implied from the content of the Will that the Testator was not able to express his own free will in the document.

The holographic Will has to include the date when it was drafted, an indispensable requirement especially if the testator has left more than one Wills (the most recent supersedes any earlier, if in conflict) . Finally, the signature of the Will is also required to be placed at the end of the Will, under the Testator’ s own handwriting and not through seals, stamps or any other mechanical means, in order to cover the entire content of the Will.

After its drafting, the Will should be handed to a trusted person in order to take care of its probate after the testator’s passing

Finally, it should be noted that when there is property in Greece, the drafting of a Greek Will (according to the Greek Law) is strongly recommended.

The “haratsi” (Special Fee imposed on Power Supplied Buildings) on your Greek properties

OPA Magazine, March 16, 2012

In an attempt to increase the revenues of the Greek State and decrease the Public Debt, the Greek Ministry of Economics established the imposition of a special fee imposed on power supplied buildings. Although this fee was initially imposed for the year 2011, the increased revenues that the Greek State has received, made the Greek Ministry decide to start collecting the fee on a more permanent basis. Thus, the Special Fee on power supplied buildings (officially called as E.E.T.H.D.E., but also referred as “haratsi”) will be imposed for the year 2012 and most likely for the following years.

How is this fee collected? The Greek Ministry has decided the collection of the fee through the power supply corporation (D.E.H.) bills and its collection for year 2011 in two equal installments (as the law came into force on October 3, 2011) and in four equal installments for year 2012. Hence, the power supply bills include since October 2011 not only the electricity consumption, the Municipal Taxes and Public Television fees, but also the new Special Fee on Properties.

Liable to pay the new Tax is the person who owns the property and/ or the one who uses and occupies it (i.e. the life estate owner, the “epikarpotis”). In cases of joint ownership on a property, all joint owners are liable to the payment of the fee, each according to his share of co-ownership on the property. However, if the property is rented, the tenant, who receives the power supply bill, pays the Special Fee, with the charges connected to the power supply bill, but may set off and deduct the amount corresponding to this special fee from the monthly rent.

How the fee is calculated? The fee is calculated based on the size of the power supplied building (apartment, shop, storage room), the tax value of the area where the property is located, the antiquity of the property, and these details are presented on the Power Supply bill.

Are all properties liable to payment of the Special fee? Not all. Law provides that the special fee is imposed on properties with buildings used either as residences or for commercial use (i.e. shops, offices, etc), which on September 17, 2011 had power supply either from the Public Electricity Company (D.E.H.) or from other suppliers. Hence, from the above special fee are mainly exempted: the properties of the Greek State, properties of the Greek Church or properties of other religions used for religious or for charitable services, properties used by legal entities for educational, religious, artist, charitable causes, properties of sport unions, properties of foreign States, used as Embassies or Consulates, properties that on September 17, 2011 did not have power supply, communal spaces of buildings, archaeological or historical monuments, plots with no buildings. A deduction from the above tax is also provided on properties used as primary residences, in case their owners are unemployed or have serious health problems.

Failure to pay this Special Fee through the power supply bill, may result to its forwarding to the competent Tax Authority for its collection and to the disconnection of the power supply, within a number of days (as per a previous ruling, within 80 days) after the power supply bill is due and payable.

Although the collection of the “haratsi” through the electricity bills is highly legally contested, it should be paid and not avoided.

Unauthorized construction (“afthereta”) in Greece. Declare it now and save it!

OPA Magazine, February 14, 2012

One of the greatest problems that the Greek State encounters and has not resolved yet, is the problem of unauthorized constructions, i.e. constructions on buildings without obtaining a proper building permit from the competent Zone Plan Authority or by exceeding the provisions of the building permit.

In an attempt to resolve the matter, a new law (4014/2011) has come into force from the Ministry of Environment, Energy and Climate Change. Properties with unauthorized constructions built before July 28, 2011 not falling under the exemptions provided therein (constructions built before 1955, “legalized” through previous laws, properties built in forests, by the beaches, in archeological sites, etc…) can be “legalized” for a period of 30 years.

This law grants to owners the opportunity to legalize the unauthorized constructions by following a specific procedure:

- Use the services of a civil engineer, who, upon inspection of the property, will verify the unauthorized construction (without or by deviating from the building permit).

- Submit an application with the civil engineer’s report through the Ministry’s web page.

- Pay the fee for legalization which arises from 500€ to 6.000 €, depending on the size of the unauthorized constructions. The above steps have to be fulfilled by February 28, 2012.

- The civil engineer needs to submit the entire documentation file (drawings, deeds, E-9 tax statements, etc…) by March 31, 2012 in order for the legalization to be effected and the final penalty to be determined. Payment of the penalty can be effected in up to 48 monthly installments.

Upon submission, a certificate of settlement of unauthorized construction is issued.

What happens if someone decides not to proceed with the legalization of the unauthorized constructions? Except for the penalties of construction and maintenance of unauthorized constructions that the owner has to pay if the competent Authority discovers the construction, the law sets a severe prohibition on conveyances effected after September 21, 2011: any conveyance of properties (with exemptions, such as the acceptance of inheritance deed) with unauthorized constructions or constructions with a change of usage (e.g. when a storage room is used as a residence), is void and invalid. In order for the Greek State to control such conveyances, it is provided that the Notary Public who executes the conveyance Deed is obliged to request and attach to the Deed a certificate from a civil engineer that there are no unauthorized constructions on the property and in case there are, a certificate that these are exempted from the above law or have been legalized according to its provisions.

So, our suggestion is: declare it now and save it!

ERT World Australia: Episode 3

January 2012

Mr. J. Tripidakis’ interview on ERT World Australia.

Mr. J. Tripidakis — Secretary of the Cretan Federation of Australia and New Zealand

Reception of the 32nd Conference of the Cretan Federation in Sydney

January 7, 2012

Military obligations in Greece for Greek Australians

OPA Magazine, November 22, 2011

The acquisition of the Greek/European Passport by Australia born Greeks, can be motivated by moral, social or economic reasons. It gives them the unique privilege of free movement, establishment, labour and enjoyment of social benefits in 26 different countries and a 480.000.000 people market. Notwithstanding the benefits, all males from 18 through 45 years of age acquiring the Greek Passport, could create military obligations for themselves. Let us examine these in detail.

According to articles 6 and 7 of L. 3421/2005, the duration of the military service in Greece is 9 months. Some categories of citizens, including permanent foreign residents are entitled to a reduced military service of 6 months.

But who is considered to be a permanent foreign resident according to Greek Law? According to by Law 3421/2005:

- Anyone who has his primary and permanent residence abroad for at least eleven consecutive years in one or more countries and

- Anyone whose center of business activity and residency is abroad for at least seven consecutive years in one or more countries.

In fact, article 6 of Law 3421/2005 states that those who belong to the first category of permanent foreign residents, may be dismissed from the Armed Forces by completing three months military service, i.e. at half the time. The only condition is that the said citizen is born and raised abroad. Therefore, a Greek Australian who was born in Australia and has grown up here, is bound in three-month military service.

However, the beginning of the military service is postponed for as long as foreign residents retain their residence abroad. In practice, this means that as long as a Greek Australian lives abroad (e.g. in Australia), his obligation is continuously postponed, until the time that he reaches the 45th year of age, at which time he is lawfully and permanently dismissed .

The loss of the said foreign residency status occurs either by deportation to Greece, or by exceeding the period of six months residency in Greece during the same year. This naturally implies the obligation for enlisting in the army.

It is noteworthy however that if a foreign resident wants to come to study in Greece, the years of studying are calculated as time spent abroad. In case of non-completion of the studies, the foreign resident is able to stay in Greece until he becomes 28 years old. If he remains in Greece for longer than six months after his 28th birthday, then he must enlist in the Army.

Anyone can voluntarily disrupt the postponement of enlisting in order to fulfill his military duties in case he wants to come and live in Greece.

Finally, it should be noted that the above are general legal provisions. For every specific case prior legal advice should be sought.

Parental Gifts in Greece

OPA Magazine, October 17, 2011

Q: What is a parental gift?

A : In essence it is a gift from parents to their children. One of the fundamental principles of Greek Civil and Tax Law, is the protection of the family and the supply of adequate assets to children from their parents in order to assist them towards the creation or the maintenance of their own family or their financial independence, or business set up.

Q: How is it effected ?

A: Orally, unless real estate property is included, in which case the execution of a Notarial Deed (Simvoleografiko eggrafo) is necessary – by both parties, as well as its subsequent registration in the competent archives of the competent Land Registry (Ypothikofilakeion) and/or Land Registry Cadastral (Ktimatologio) of the property’s location.

Q: Can I request a parental gift from my parents?

A: Greek Law regulates Greek Parental Gifts favourably. However, in no way, the children have the right to demand such parental gift, by claiming the gift through court proceedings.

Q: Is there a favourable tax treatment for parental gifts?

A: Yes, a parental gift is not taxable if the (tax) value does not exceed 150.000 €. If the value of the property exceeds 150.000 €, then the tax escalates from 1% up to 10% of the value above this limit. Tax payment may be made in 12 equal instalments. Each instalment cannot be less than 500 €.

Q: What is this “tax value” that the parental gift tax is calculated upon?

A: Pre-set values that the Greek Tax Authority has indexed almost all real properties in Greece. Usually it is lower, if not much lower than their actual market value.

Q: Can a parental gift be revoked?

A: Yes, in case the grantee has proven to be ungrateful toward the grantor or to the grantor’s spouse or to any other of his close relatives and especially, if he has not fulfilled his obligation to provide support to the grantor. Such revocation is only performed through a statement of the grantor to the grantee. The revocation is excluded in case that the grantor has forgiven the grantee, or if a year has passed since the time that the grantor became aware of the reason for revocation, without proceeding with same. Finally, the revocation of the Greek Parental Gift, is prohibited when the gift has been performed due to legal or moral obligation.

Q: I want to proceed with a parental gift to my daughter, but I wish to keep the right to collect the rents. Can this be done?

A: Yes, you may convey only the remainder [or naked ownership (‘’psili kiriotita’’)] and for you to keep the life estate (‘’epikarpia’’). In this case:

- The parent retains the right to use and enjoy the property for as long as he lives

- The child pays less tax since the taxable value of the parental gift is lower.

- After the death of the parent, the naked ownership (‘’psili kiriotita’’) of the child, will automatically unite with the life estate (‘’epikarpia’’) in full ownership, without the probate of the estate or any other procedure required.

Q: What are the relevant costs involved?

A: The costs include the tax, the notary public’s etc fees and the cost for the registration of the Deed at the Land Registry. They can all be calculated before-hand so you have a clear picture of all the necessary expenses

Q: If I convey my property in Greece to my children through a parental gift, do I have to draft a Will (for my Greek property) as well?

A: No, your children will acquire Title at this stage and thus you will save them from greater suffering, confusion and tax complications in the future.

Q: My children and myself live in Australia. How can a parental gift to them of my property in Greece be effected?

A: It may be accomplished through a limited Power of Attorney to a specialised Greek lawyer, like our Greek firm.

Adverse possession (“Hristiktisia”) on Greek property. Greek Australians beware!

OPA Magazine, October 7, 2011

Ownership on real estate property in Greece can be acquired not only through a conveyance Deed (purchase, gift etc), but also through adverse possession (“Hrisiktisia”). According to the Hrisiktisia provisions, any person that is exercising acts of possession on any property (even belonging to a third person), claiming it as his, for an uninterrupted period of 20 years, becomes the undisputed owner of such property.

It is obvious that the main danger that Greek Australians neglecting their property in Greece run, is to lose it, to the benefit of any potential trespasser.

The acts of possession leading to Hrisktisia, include the: use, cultivation, fencing, renting it further, parking the car, storing objects, building upon, walking or moaning the sheep through it, etc.

Legally speaking, the only way to stop Hrisiktisia, is the filing of an eviction lawsuit (“diekdikitiki agogi”) before the Greek Courts against the trespasser. Protests to the squatter, complaints to the local Police etc, do not interrupt the Hrisiktisia. However, actually speaking, the main advise is not to neglect your property. How can this be effected? Well, I would suggest the following acts, as general guidelines to Greek Australians, so their Title is not in jeopardy:

- Take care of all the necessary ownership and inheritance legal procedures including probate of the Estate and Acceptance of the Inheritance (if you have inherited it). Comply to the annual tax requirements (E1, E2, E9 etc).

- Make sure that your Title is uncontested and properly recorded in the competent Land Registry (“Ypothikofilakeion”) and/or Land Registry Cadastral (“Ktimatologio”). Safe keep a certified copy of your Title together with its Certificate of Registration from the Land Registry.

- Fence it, to keep squatters off; affix a sign on the fence with your name.

- Beware of Greek relatives “taking care” of your property If you have somebody using or cultivating it (even a relative co-owner), make sure that you have executed the proper legal documents to protect you.

- Visit it (yourself or your relatives or friends) whilst traveling to Greece and confirm its actual status. Take pictures of your family (or your friends) at your property.

- If you are not in a position to visit, then employ a trusted person (preferably a professional – lawyer or other) and ask him to visit, take pictures and e-mail them to you. Ask for his report in writing. Any signs of trespassing (e.g. a vehicle parked on your land) should alarm you.

- Have a survey (topographic diagram) of your land drawn. This will also help you get a price idea of your property.

- Etc

All the above will help you avoid infringements on your property leading to potential loss of your Title. Keep always in mind that you should not be a “sitting duck” for potential squatters, but a “vigilant owner” instead!

Even more documents (revenues?) required for property conveyances in Greece

OPA Magazine, September 24, 2011

According to Law 4014/2011 (enacted on September 21, 2011), the general approach is that a property in Greece cannot be conveyed or mortgaged, if :

- there is a building on it which has been built without the procurement of the Building Authority’s license, or by deviating from the license, or

- there has been a unilateral change in its licensed use.

According to art 23 par 4 of the above Law, during every conveyance or placement of a mortgage etc on any property, its owner and an engineer must certify in writing that all existing constructions, are according to the building license. Omission or false statement on the above, crates a serious criminal and civil liability to all involved parties, including the public notary, the contracting parties, their lawyers, the real estate agents and the land registrar, reaching to a minimum 6 months of imprisonment and a fine from 30.000 to 100.000 Euros. Moreover the practicing license of the (falsely stating) engineers is suspended.

Is there a remedy for these illegal constructions? Well, through the timely submission of an application to the Building Authority together with various documents (e.g. the E9 tax statement, an engineer’s report etc) and the payment of a fine (up to 6.000 Euros), the imposing of sanctions (demolition included) is postponed for 30 years. The deadline for the relevant application expires on November 30, 2011.

In practice, almost all the buildings in Greece during the last decades have deviated from the terms of the initial building license, mainly with the creation of “imiipethrioi”, i.e. balconies that have been turned to rooms. Realistically, it is now a good chance (and maybe the last?) to legalize such defects and avoid the serious sanctions. But, do hurry!

Additional documentation required for property conveyances/leases in Greece

OPA Magazine, September 15, 2011

According to Law 3661/2008, measures have been taken for the reduction of the buildings’ energy consumption. Subsequently, the new Regulation on Buildings’ Energy Consumption (Gov. Gazette Vol B No. 407/2010) has been issued. This Regulation adds one more document as a prerequisite for the execution of most purchase/sale deeds and lease agreements of buildings in Greece.

More specifically, this is a document required for: a) any purchase/sale of a new or totally renovated building, or b) any purchase/sale of building or part of building (i.e. apartment) or c) lease of building, d) any lease of part of the building which is being used as residence or business establishment which will be executed after 9 January, 2012. The issuance of this certificate is compulsory for buildings of total surface more than 50 sq. m., serving basic needs such as residence, offices, commercial use et.c.

The Certificate of Energy Attribution classifies the buildings in categories (there are nine categories, from A+ to H). The decisive factor for this classification is the buildings’ energy attribution i.e. the energy which is consumed for meeting the needs of heating, cooling, lighting etc. The Certificate also includes several general information concerning the building (i.e. photo of the building, use, year of construction etc), information about the emissions of carbon dioxide as well as measures/recommendations regarding the amelioration of the energy attribution.

These Certificates are exclusively issued by engineers included in the Ministry’s of Environment lists (“Special Record of Energy Inspectors”). The relevant charges, start from the minimum fee of 150 Euros for the inspection of an apartment and of 200 Euros for the inspection of the entire building.

Unless such a Certificate is produced, no conveyance deed can be effected by the Public Notary and no lease contract can be certified by the Tax Authority.

CONVEYANCE OF REAL ESTATE PROPERTIES IN GREECE

OPA Magazine, September 6, 2011

One of the most important sections of financial activity in Greece is the conveyance of real estate properties with exchange. Property conveyancing can be effected only through a Notarial Deed (simvoleo) before a Greek Notary Public (simvoleografos). Ownership is perfected through the registration of this Deed, before the competent Land Registry (Ypothikofilakeion) and/or the Land Registry Cadastral (Ktimatologio) of the property’s location.

In a sale, the first and indispensable legal step for the buyer’s lawyer, before the execution of the Deed, would be to conduct a title search on the real estate property to be purchased, before the relevant archives of the competent Land Registry (Ypothikofilakeion) and/ or the Land Registry Cadastral (Ktimatologio) of the property’s location. Through this and through reviewing all relevant listings, either under the name of the owner, as depicted in the Land registry archives, or under the entries, noted under the specific property (in areas where the Land Registry Cadastral is already in effect), the absence of legal flaws is ensured, as well as the lack of registered burdens, lawsuits, seizures, mortgages imposed against the property.

In Greece, there is no centralized or computerized land registry data base, so the lawyer effecting the title investigation has to actually travel to the competent Land Registry at the place where the property lies and go through volumes of books, usually hand written.

When the seller lives overseas, the sale proceeds can be freely remitted abroad without any restrictions.

Greek law on conveyances provides a number of restrictions to the purchase of real estate properties in specific areas of Greece, which have been characterized as “border areas”. These restrictions apply to foreigners for national security reasons. For the execution of any conveyance Deed within these areas, permission by the National Board of Defense/ Ministry of Defense is required. The above permission is not required for people who have the Greek Nationality or are descended from Greek parents and to the citizens of the European Union, as well.

Prior to the execution of the conveyance Deed, a number of documents is required (i.e. issuance of tax registration number, certificate of tax clearance, certificate that there is no Inheritance/ Gift tax due, if the property was acquired by the seller through Inheritance or Gift, Municipal Tax clearance, copy of the building permit, in case that the building permit was issued in 1983 and later, a topographic diagram, when plots are conveyed, etc.); additionally, the submission of the conveyance tax statement, by virtue of which the parties declare to the tax authority the payment of the imposed tax, is indispensable. Sale tax rises to aprx 11%.

Usually, there is no capital gains tax for property sales of individuals.

The entire transaction and registration of sale at the relevant Land Registry/Ktimatologio authorities, can be effected through a Special (Limited) Power of Attorney, by a qualified and experienced lawyer

Greek Festival ANTIPODES on 4th & 5th March 2011, Melbourne

Radio 2mm

March 2011

Mr. Tripidakis presents “Legal Matters in Greece”, a live program on the Greek radio station ![]() in Marrickville (Sydney), on Wednesdays at 1 pm, providing the Greek Australian audience with all useful information and guidance regarding legal matters in Greece.

in Marrickville (Sydney), on Wednesdays at 1 pm, providing the Greek Australian audience with all useful information and guidance regarding legal matters in Greece.

2nd INTERVIEW ON ANTENA PACIFIC GREEK TV CHANNEL — MONDAY 7TH FEBRUARY 2011

January 26, 2011

Mr. John Tripidakis, hosted by Maria Alyfanti’s program “Open Line”, is being interviewed on legal matters in Greece of interest to Greek Australians (Estates, Greek passport, etc).

Antenna Pacific, on Monday 7th February 2011, at 9.00 pm.

Laiki Bank Business seminar — “Demystifying Legal & Business matters in Greece”

Melbourne, November 2010

Mr. Tripidakis has delivered a successful informative session regarding Legal & Business matters in Greece at the Demystifying Business & Legal Matters in Greecee Invitation the 23rd November 2010.

His All Holiness Ecumenical Patriarch Bartholomew I

Business Guide for Greece — new!

July 2010

We are pleased to inform our clients and visitors of our web site that we have issued our Business Guide for Greece.

Doing Business 2010

May 2010

Mr. John Tripidakis has been awarded for his contribution to the annual edition “Doing Business 2010: Reforming through Difficult Times”, concerning business activity regulations, carried out by the World Bank and the International Financial Corporation (I.F.C.).

Real-Estate in Greece

May 2010

Mr. John Tripidakis will deliver his next informative session about “Real-Estate in Greece”, on Wednesday 26th May, 2010, at 7:00pm. Venue: The Greek Orthodox Community of Melbourne and Victoria (corner Russell & Lonsdale Streets). At the end of the session, Mr. Tripidakis will answer questions from the audience. Entry is free. All welcome.

Practical Legal Guide for Greek Australians

Sydney, January 2010

We are pleased to inform our clients and visitors of our web site that we have issued our Practical Legal Guide for Greek Australians integrating recent developments, new laws in effect and up-to-date tax calculation tables.

Affiliate office in Sydney

December 2009

We are happy to announce that our firm has joined forces with the Law offices of John Tomaras ( JT Law Pty Ltd ) in Sydney, NSW. We look forward to a successful and fruitful collaboration.

Weekly live broadcasting on SBS Australian Radio Station

Summer 2009 – 10

Mr John Tripidakis, is being interviewed on Greek Law every Sunday at 6 p.m. (Sydney time) by George Messaris at SBS Radio Station (1204 or 1106 AM)

Registration at the Melbourne and Sydney Bars

Spring – Summer 2009 – 10

Mr John Tripidakis, being in Australia as of November 2009 and having followed the prescribed procedure, has registered at the Legal Services Boards of Victoria and New South Wales as an Australian registered foreign lawyer qualified to advise on Greek Law in Australia.

Updated Legal Guide for Greek Australians

Athens, November 2009

We are pleased to inform our clients and visitors of our web site that we have republished our Legal Guide for Greek Australians integrating recent developments, new laws in effect and up-to-date tax calculation tables.

Legal & Medical Conferences in Greece and Australia

October 4, 2009

We happily announce the successful completion of the Corfu 2009 Conference (www.greekconference.com.au) that took place in Corfu, Greece (26 September–2 October 2009) with the subject “Facing Change in Law, Medicine and Science”.

The works of the conference were attended by distinguished lawyers, doctors and other academics from Australia.

John Tripidakis, LLM (London), participated at the Conference, as an expert in Greek Inheritances and real estate law.

12th Greek-Australian Legal Conference (www.LMconference.com.au)

June 9, 2009

We happily announce the successful completion of the 12th Greek-Australian Legal Conference on Our Challenged World: How Law & Medicine Respond? that took place in Samos, Greece (May 31 through June 6, 2009).

Official guests of the conference, were: the Governor of New South Wales, Professor Marie R. Bashir AC CVO, the former Justice of the Supreme Court of Victoria and President of the Court of Appeal, Hon John Winneke AO QC RFD and P. President of the Royal Academy of Engineering and Chairman of the House of Lords Science and Technology Select Committee and Vice-Chancellor of the University of Cambridge, Lord Alec Broers FRS.

The Hon Jeremy Newton, Ambassador of Australia to Greece was also present at the conference.

Greek Lawyer John Tripidakis LLM (London), delivered his speech on “Greek Taxation and Real Estate” (www.greeklawyers.com.au)

12th Greek-Australian Legal Conference (www.LMconference.com.au)

June 6, 2009

John Tripidakis, Esq., will participate as the speaker on “Greek Taxation and Real Estate”. The Conference will be held in Samos, Greece with the presence of the Governor of New South Wales, Justices of the Supreme Court of Victoria and other distinguished academics.

Get in touch

E: mail@greeklawyers.com.au

Melbourne address

15 Chester Street,Oakleigh, VIC 3166

Sydney address

C/: Constantine & Co. LawyersLevel 1, Suite 3,

55 Railway Parade,

Kogarah, NSW 2217

- Home

- Why John Tripidakis?

- John Tripidakis's Experience

- John Tripidakis in Australia

- Practice Areas

- News

- FAQ

- Client Comments

- Contact Us

John Tripidakis is one of a very few lawyers registered with the Athens Bar who is entitled to practise Greek law in Australia as an

"Australian Registered Foreign Lawyer" and is not entitled to, and does not practise Australian law.

In association with Estates Overseas Pty. Ltd.

Disclaimer: The present web page does not constitute legal opinion or analysis. For such opinion/analysis to be rendered and provided to client, specific case particulars, facts, events, documents etc. must be submitted to lawyer's attention, whereupon lawyer will advise the client vis-à-vis the same. John Tripidakis bears no responsibility if any generalised or summarised legal advice, such as law provisions included in this web page, ultimately fails to apply in client's specific case, as generally described at this stage before lawyer is retained to represent client.